The software provides an entire financial picture of an individual including credit score, payment history and avoiding financial mistakes that arises. The personal financial software allows quick comparison of your expenditure. It provides spending category that corresponds to the user daily life. Personal finance software is designed to make it simpler to manage finances and should be customizable to meet the user's needs.Ī good software should be user-friendly and provides several benefits: No late payment by helping schedule reminders for paychecks, provide an easy budget plan other than using a spreadsheet or white paper. Personal Finance software is easy to get and are available in mobile apps, as online programs or installation program in personal computers.

What are the Top Free Personal Finance Software: Microsoft Money, KMyMoney, HomeBank, Mint, ClearCheckbook, Alzex Personal Finance, AceMoney Lite, Doxo are some of the Top Personal Finance Software Free. You may like to read: How to Choose the Best Personal Finance Software for You? What are the Top Personal Finance Software: Banktivity, Moneyspire, CountAbout, Moneydance, BankTree, Buxfer, Money, Quicken, Mvelopes, YNAB, Qapital are some of the Top Personal Finance Software.

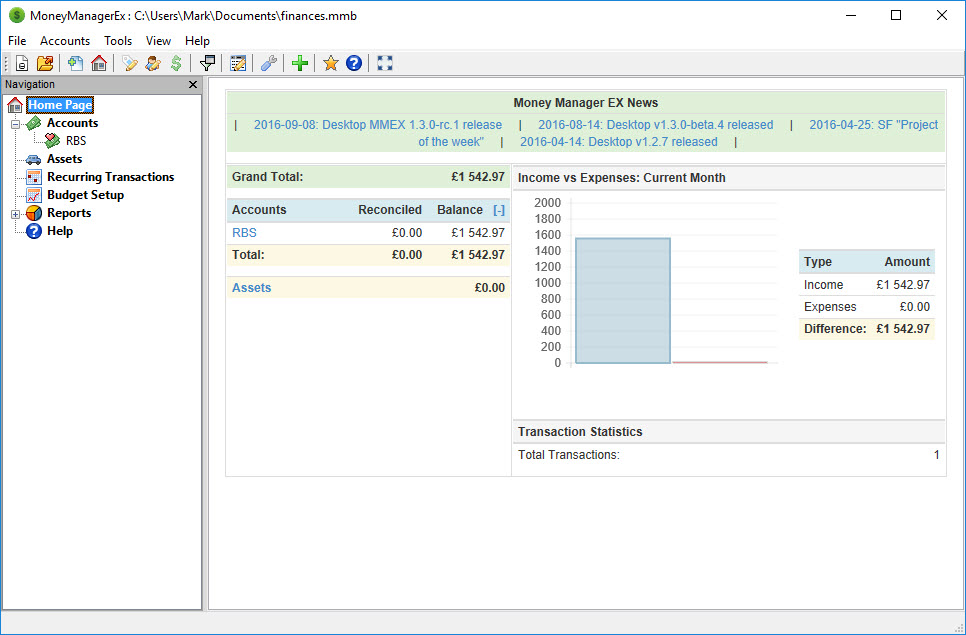

Some of the Personal Finance software has an alert notification that notifies the user once the target is surpassed. The module for tax the program provides a tax form preparation, allows financial data to be transferred to other software and provide tools that help the user to return e-filings. The finance management module allows the individual to account for records such as income and expenses, investments, financial planning and other financial analysis. Personal Finance software has two categories management of finance and a tax module. One of the main function of personal finance software is synchronizing the user's credit card, banks, assets, investments with the program to produce a financial record. In a simpler term, personal finance software educates the user about his personal money matters. The main functionality of a personal finance software is to be accountable for how much money a person has, track the expenses, provide insight into your usage and generate reports that will help analyze assets. Personal Finance Software is a system that has been designed to integrate all individual finance data. General features include Budgeting, Banking, Planning, Investing and Reports. Most of these track and display your budget, spending, banking, bills, savings, investments, retirement plans and debt levels. These are either web based or stand alone and provides a personal finance or money management dashboard for your money, tracking your transactions and giving you early warning when problems arise. Personal Finance Software are money management software that organizes your day to day financial life in an easy to view with automatic updates of the transactions.

0 kommentar(er)

0 kommentar(er)